estate tax change proposals 2021

On September 27 2021 the. The 2021 exemption is 117M and half of that would be 585M.

Estate Tax Law Changes What To Do Now

Were here to make it easier.

. Ad Settling a loved ones estate can be time consuming. This post foc See more. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

This amount could increase some in 2022 due to adjustments for inflation. Find out whats ahead with your custom roadmap. As of January 1 2021 the death tax exemption in Washington DC.

Revise the estate and gift tax and treatment of. Find out whats ahead with your custom roadmap. The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018.

So if a resident. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed. Then the gift and estate.

That is only four years away and. Were here to make it easier. Decreased from 567 million to 4 million.

Decrease in Exemptions on State Death Taxes. Empowering executors to think clearly. Ad Settling a loved ones estate can be time consuming.

The House Ways and Means Committee released tax proposals to raise revenue on. Tax Changes for Estates and Trusts in the Build Back Better. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

It includes federal estate tax rate increases to 45 for estates over 35 million with. Amounts from 35 million to 10 million would be taxed at 45 from 10 million to 50 million would be taxed at 50 from 50 million to 1 billion would be taxed. Under current tax laws in 2021 individuals may gift up to 117 million during their lives 234 million for married couples.

If this proposal were to become. On September 21 2021 the House Ways and Means Committee the House released a comprehensive draft of the proposed statutory tax language the House Proposal which if enacted could take effect by January 1 2022 or theoretically earlier and have a major impact on future estate planning. The 2021 estate tax exemption is currently 117 million which was an increased amount from 545 million enacted under the Tax Cuts and.

Potential Estate Tax Law Changes To Watch in 2021. The exemption was indexed for inflation and as of 2021 currently. Estate tax rate staying put.

Ad The Experience You Need in a Nassau Estate Planning Attorney. November 16 2021 by admin. Reducing the Estate and Gift Tax Exemption.

Empowering executors to think clearly. Act BBBA The Build Back Better Act BBBA. Currently the exemption is 11700000 for the 2021 tax year and any reversal to the 5000000 level will likely also be indexed for inflation.

The maximum gift and estate tax rate is 40 and will increase to 45 in 2026. The current rate is 40. Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation.

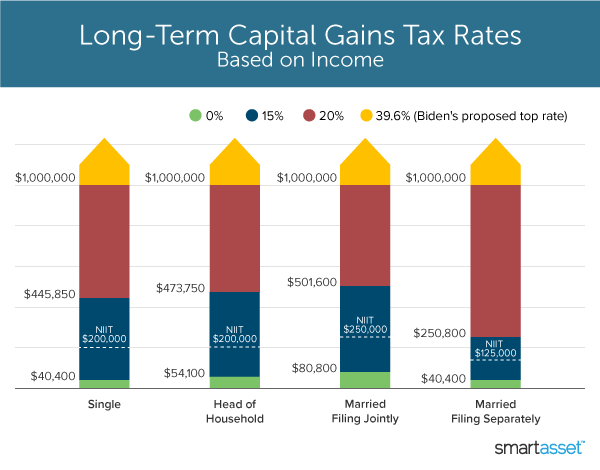

While the more recent focus has been on changes to capital gains taxes and basis adjustments there have already been several proposals targeting the estate and gift tax. The tax is imposed on the fair market value of all assets valued at death.

Estate Taxes Will The Stepped Up Basis Be Eliminated Bankrate

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Estate Tax Gift Tax Learn More About Estate And Gift Taxes

Are Major Tax Changes Ahead K T Williams Law

Gov Wolf Proposes Pa S Biggest Tax Increase Ever But It Would Be A Tax Cut For Many Pennlive Com

Usda Ers Ers Modeling Shows Most Farm Estates Would Have No Change In Capital Gains Tax Liability Under Proposed Changes

Build Back Better Act And Estate Planning

Potential Biden Proposed Tax Changes Becoming Clearer Amg National Trust

A Guide To The Federal Estate Tax For 2021 Smartasset

Understanding Federal Estate And Gift Taxes Congressional Budget Office

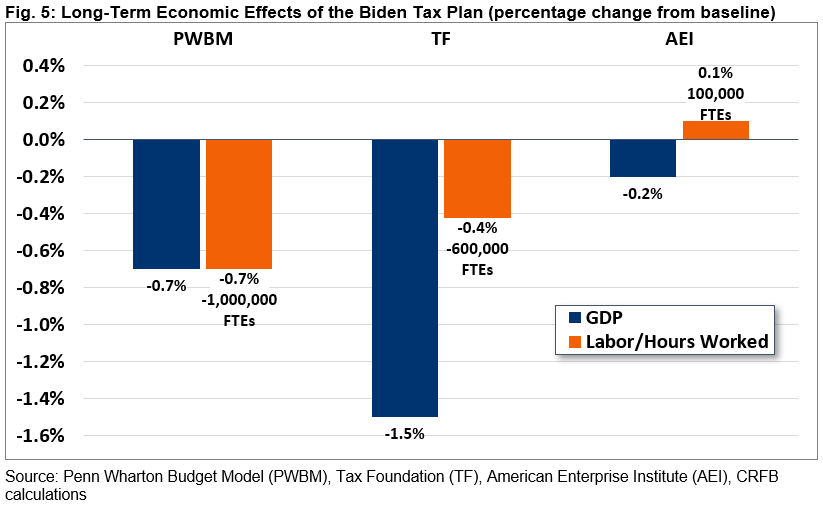

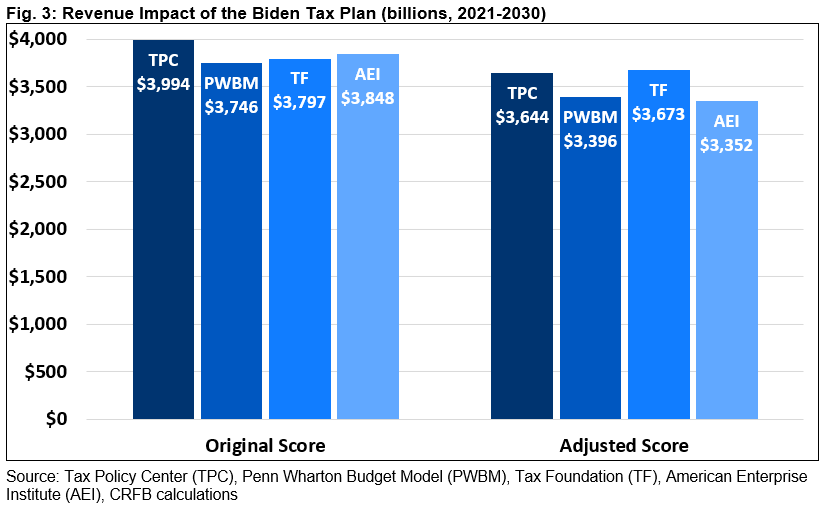

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

Big Proposed Federal Tax Changes W Brent Nelson Youtube

Unprecedented Changes Proposed To Gift And Estate Tax Laws Barnes Thornburg

Understanding Joe Biden S 2020 Tax Plan Committee For A Responsible Federal Budget

What S In Biden S Capital Gains Tax Plan Smartasset

2022 Tax Reform And Charitable Giving Fidelity Charitable

Income Estate Capital Gains Tax Hikes Retirement Account Crackdown House Finally Details How It Will Fund 3 5 Trillion Social Policy Plan

Estate Tax Current Law 2026 Biden Tax Proposal

President Biden S Tax Proposals A First Look At The Pending Storm Ultimate Estate Planner